Anchoring Island Conservation in Financial Permanence:

A New Community of Practice for SIDS Conservation Trust Funds

Conservation Trust Funds (CTFs) based in Small Island Developing States (SIDS) provide long-term, locally governed finance for marine protection and climate resilience. They translate blended finance into on-the-ground action, expand access to capital for small jurisdictions, and pilot innovative revenue models that donors and partners should prioritise.

SIDS manage some of the largest ocean areas on earth while supporting relatively small populations. This combination makes them uniquely vulnerable and uniquely important for global conservation. Conservation Trust Funds that are based in and designed for SIDS play a central role. They convert international finance into locally accountable funding that keeps Marine Protected Areas functioning, supports community stewardship, and underpins national biodiversity and climate goals.

NOT YOUR AVERAGE TRUST FUND

Operating within a small island context gives SIDS-CTFs four distinctive strengths relative to their continental peers:

- Ocean-focused and tailored instruments: SIDS funds routinely use ocean-specific tools, including debt-for-nature swaps, sovereign blue bonds, blue carbon mechanisms and reef insurance.

- Local stewardship, global finance: These funds act as trusted intermediaries. They preserve donor intent while moving resources to national park agencies, local NGOs and community groups.

- Scale through pooling: Regional endowments and sub-account models allow for individual islands to pool assets, access professional investment management and lower administrative fees collectively.

- Accessible, capacity-sensitive grantmaking: SIDS funds design microgrant windows i.e. simplified applications and applicant support that allow marginalised local actors to participate.

PROOF OF CONCEPT: ISLAND FUNDS THAT DELIVER

Across regions, these funds are demonstrating practical innovation by adapting global finance tools to fit island realities. The following examples, drawn from SIDS-CTFs all over the globe, emphasise local ownership, cultural framing of stewardship, and the flexibility needed to mobilise diverse revenue streams:

The Seychelles Conservation and Climate Action Trust (SeyCCAT):

Debt-for-nature swap created a Blue Grants Fund and a Blue Endowment Fund; the Trust later supported the government’s Blue Bond and manages multiple grant windows. SeyCCAT amended its founding legislation to allow up to 30% of certain income streams for administrative costs to reflect scaling realities.

Lesson: Legislate for permanence but retain pragmatic rules for realistic administration.

Belize Fund for a Sustainable Future:

Used debt-swap savings to create a conservation trust fund that channels sinking funds over twenty years to government agencies and community groups; and an endowment to provide sustained financing for ocean governance and the blue economy, after the sinking funds end.

Lesson: Structure grant proceeds to balance national priorities and community access.

Caribbean Biodiversity Fund (CBF)/ Micronesia Conservation Trust (MCT):

CBF features a regional endowment and sub-account model that pools investment to achieve scale, lowering management costs and professionalising investment management for member countries. Similarly, MCT was established as a regional conservation finance vehicle for the Micronesia Challenge (it was only in FSM before this), MCT manages national and regional endowments and grant programmes across multiple jurisdictions. Historically MCT has managed a regional endowment in excess of USD 10M (early reports cite ~USD 11M endowment balances) and acts as a pooled mechanism to channel funds into national protected-area networks and community projects. MCT’s regional pooling enables smaller Micronesian jurisdictions to access professional investment management and larger grant envelopes than they could individually raise, reducing fees and improving fiduciary standards.

Lesson: Use pooled endowment and shared services to lower fees and increase professionalism across smaller funds. Regional pooling enables small island jurisdictions to scale conservation finance, reduce costs and access professional investment standards.

Niue Ocean Wide Trust (NOW Trust) & Ocean Conservation Commitments (OCCs):

NOW Trust is a charitable trust (New Zealand law) capitalising its endowment through an innovative public sponsorship scheme, Ocean Conservation Commitments, where individuals, corporations and foundations sponsor units (e.g., 1 km² sponsorships) of Niue’s waters for multi-decadal terms. The OCC approach is an alternate endowment-raising mechanism that monetises stewardship commitments (targeting an NZD/USD ~18M capitalisation), combines philanthropy with private sponsors, and provides certificates and reporting to sponsors. Early support from large philanthropies (including a multi-million grant from Bezos Earth Fund) and NGOs (e.g., Conservation International) underscores the model’s potential for replicability among SIDS seeking market-oriented, gift-style/crowd sourced revenue streams. Commentary and reporting indicate strong initial uptake (millions raised toward the target within the first year).

Lesson: Market-facing sponsorship models can diversify endowment capital beyond traditional donor/government channels and engage new constituencies.

COLLECTIVE ACTION, ISLAND STYLE: GLISPA'S COMMUNITY OF PRACTICE TAKES SHAPE

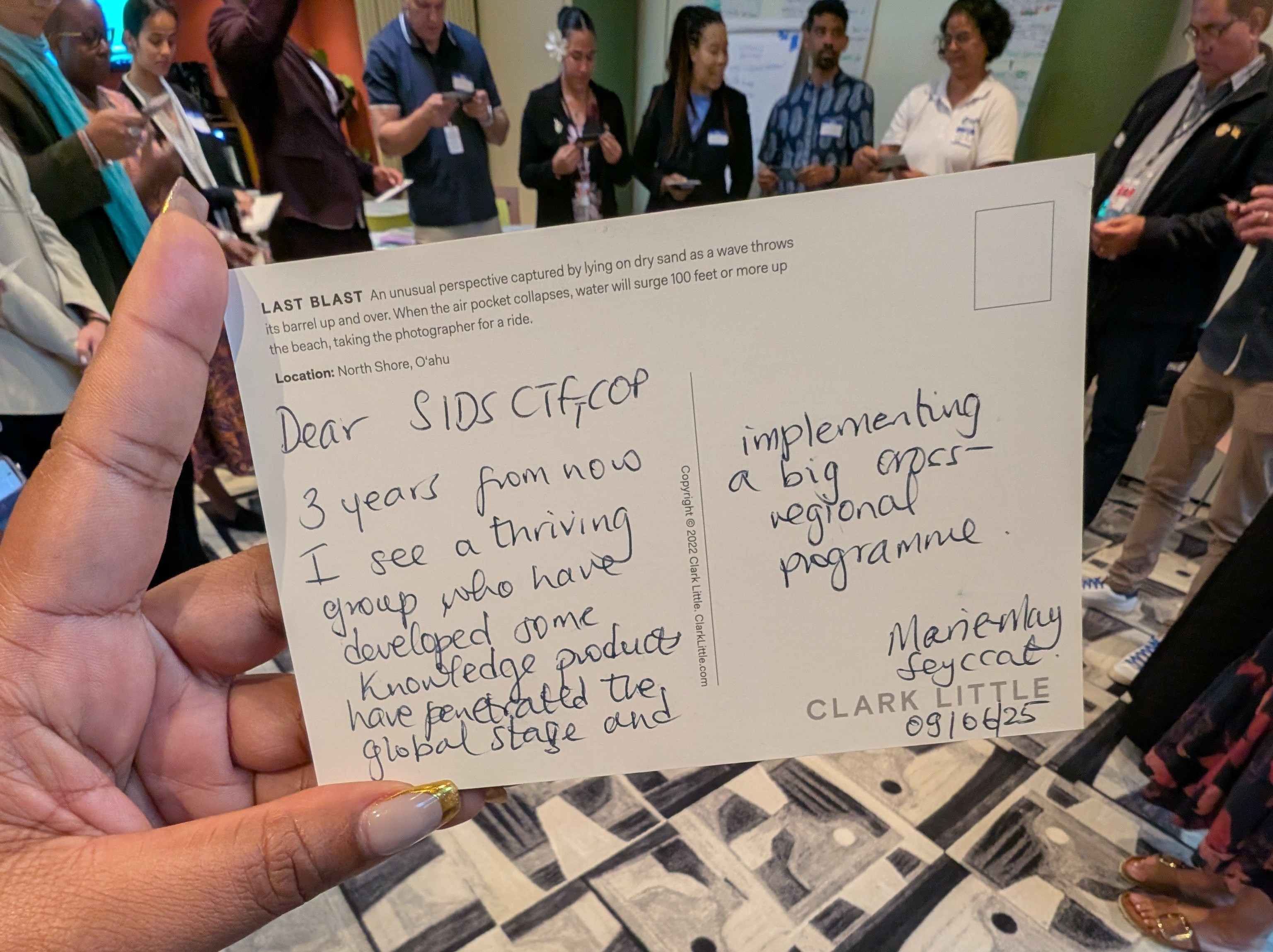

GLISPA proudly launched a Community of Practice for SIDS-CTFs at the 2024 UN Biodiversity COP in Colombia. Subsequently, at the UN Ocean Conference in 2025, we were able to convene our membership in person, which include the SIDS-CTF operations referenced above and more. At a deep-dive workshop, members and supporters defined and agreed six priorities to collectively strengthen their financial sustainability and operational effectiveness:

Capacity building for governance, management and transparency, including monitoring, reporting and learning systems (MRV and MEL).

Practical approaches to engaging the private sector in SIDS regions, with realistic expectations and risk sharing.

Improved access to international sources of finance: This includes assessing Overseas Development Assistance (ODA) trends, increasing institutional readiness for global funds, and clarifying how philanthropic and private capital can fill funding gaps.

Replicating success while avoiding competition and extraction, focusing on collaborative knowledge sharing and low-cost in-house expertise exchange.

Advocacy for a seat at the table in designing new or re-invented specialised financial instruments, including debt conversions and sponsorship models.

Promotion of CTF roles in national policy delivery, especially National Biodiversity Strategy and Action Plans (NBSAPs) and Nationally Determined Contributions (NDCs).

Together, members are charting a course for stronger governance, smarter finance, and a unified voice for island conservation.

WHAT THE WORLD CAN DO TO HELP

Conservation Trust Funds in SIDS are pragmatic tools that convert global finance into local outcomes. But they need catalytic, predictable and flexible support.

Practical asks include multi-year core funding for capacity and endowment top-ups, technical assistance for investment and procurement systems, acceptance of time-limited higher administration allowances during scaling years with transparent reporting and sunset clauses, and funding to establish regional pooled services that reduce fees and professionalise management.

The GLISPA Community of Practice provides a forum for peer learning, coordinated advocacy and collective engagement with donors and markets. If donors match that pragmatism with predictable funding and technical assistance, it bolsters the ability of SIDS-CTFs to continue to deliver marine protected areas that provide real, long-term benefits for people and nature.

Islands are leading the way in reimagining conservation finance. To learn, collaborate, or contribute to this work, contact jabal@globalislandpartnership.org and add your voice to our SIDS-CTF Community of Practice.